In the midst of tax season, most of us are concerned only about filing our tax returns on time. Many people view Form 1040 as nothing more than a compliance requirement, simply something to do and forget about.

But what if your tax return was capable of doing more?

What if the numbers on your Form 1040 could actually serve as a roadmap for smarter decisions, better investments, stronger retirement planning, and long-term wealth growth?

That’s the mindset shift we are exploring here; instead of looking at your tax return as the finish line, treat it like a yearly compass. It reveals where your money is coming from, where it’s going (or leaking), and how efficiently it’s working for you.

First things first, let’s first understand what a Form 1040 is.

Form 1040 is a standard individual income tax return for the citizens of the United States. It summarizes your total income for the year. adjustments, deductions, credits, taxes owed, and payments made. In simple terms, it shows how much you earned and how much of that income is taxable.

The government has made this document to collect revenues; at first glance, it may look like something very technical. But once you really understand its structure, it becomes much more than a compliance form. It becomes a financial mirror that reflects your habits, priorities, opportunities, and even risks.

Why is this Form 1040 important?

Form 1040 is important because it does more than just report your taxes; it officially records your financial year.

- First, it keeps you legally compliant. Filing it ensures you are following federal tax laws and helps you avoid penalties or legal issues.

- Second, it calculates exactly how much tax you owe or whether you are entitled to a refund. It brings together your income, deductions, credits, and taxes already paid to give you a clear final number.

- Third, it acts as official proof of income. Banks and lenders often request your tax returns when you apply for loans, mortgages, or financial approvals.

Now let’s explore how each part of this form can help you build a smarter, long-term wealth strategy.

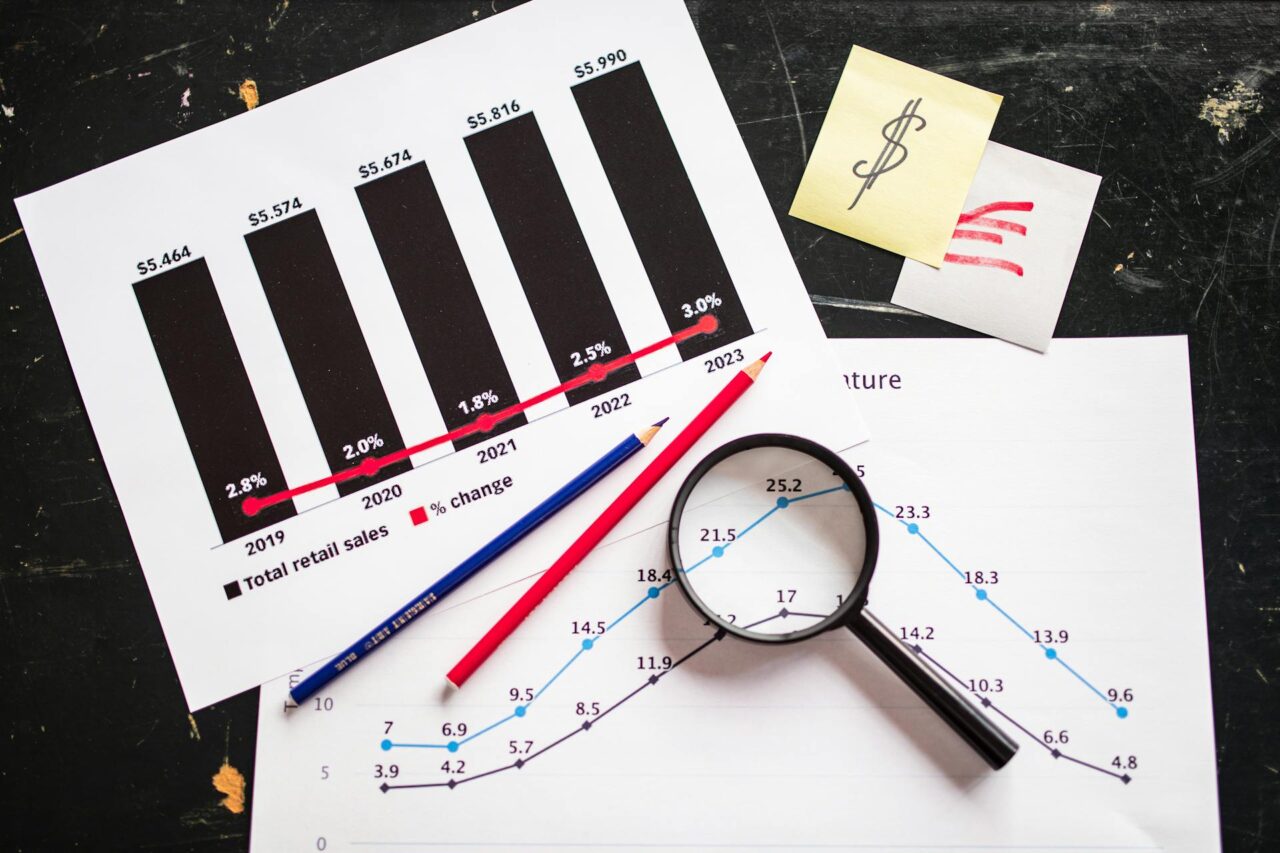

- Income section: The income portion of the Form 1040 includes wages and salaries. interest from savings accounts, dividends from investments, capital gains from selling stocks or property, business or freelance income, rental income, and distributions from retirement accounts. This section answers one essential question: How do you make your money? If most of your income comes from a single paycheck, that may indicate stability but also concentration risk. Relying on one employer or one income stream can limit flexibility. On the other hand, if your income is diversified across investments, business activities, and assets, it suggests that your money is working in multiple ways. From a long-term wealth perspective, reviewing this section annually can help you with:

- Identify overdependence on earned income

- Explore passive income opportunities

- Evaluate whether your investments are generating consistent returns or not

Wealth is not only about earning more. It’s about building multiple streams that support each other over time.

- Adjusted Gross Income (AGI): After listing total income, Form 1040 calculates Adjusted Gross Income (AGI). AGI is your total income minus certain allowed adjustments, such as retirement contributions, student loan interest, or health savings account contributions. This number plays a powerful role in tax planning. AGI determines eligibility for:

- Certain deductions

- Education-related benefits

- IRA contribution limits

- Healthcare-related credits

A rise in AGI typically indicates the growth in your wealth, but it may also push you into higher tax brackets or reduce eligibility for benefits. For strategic financial & wealth management:

- You can manage your Retirement contributions

- Keep checking in on Health Savings Accounts

- Build a Strategic timing of income

- Build a Tax-efficient investment strategy

Instead of reacting to taxes at year-end, reviewing your AGI helps you plan proactively for the future.

- Deductions: Deductions reduce taxable income, but some of them also reveal financial patterns. For example:

- Business deductions show operational expenses and profitability.

- Charitable contributions reflect noble goals.

- Medical deductions may highlight rising healthcare costs.

Rather than seeing deductions purely as tax-saving tools, ask deeper questions like, “Is my debt structured efficiently?” “Are my business expenses aligned with growth?”

This is simple. Deductions tell a story about where your money is flowing and whether those flows support your long-term financial goals.

- Capital Gains and Investment Behavior: If you sold investments during the year, capital gains will appear on your Form 1040. This section generally reveals:

- Whether you’re investing long-term or trading frequently

- How tax-efficient your portfolio is

- Whether gains are short-term or long-term

Short-term gains are typically taxed at higher rates than long-term gains. If your tax return consistently shows short-term gains, it might indicate frequent trading, which could reduce overall after-tax returns. A long-term wealth strategy focuses on disciplined investing, tax efficiency, and portfolio balance. Here, your tax return becomes a valuable checkpoint to evaluate whether your investment behavior is supporting your financial growth.

- Retirement Contributions and Withdrawals: This is another crucial section that your tax return filing reflects. It shows the contributions you made for your retirement. This can detect whether you are contributing enough for your retirement or whether you are maximizing your tax-advantaged accounts. If contributions are low, it may signal a missed opportunity to reduce taxable income while building long-term wealth. If withdrawals are increasing, it might be time to evaluate whether your retirement income strategy is tax-efficient.

Conclusion: Let’s be honest, most of us just want to file our taxes and move on, but your annual tax return is much more than just a simple obligation; it’s a powerful tool for proactive wealth building. You just need to review it thoroughly.

And you gain insights into income diversification, tax efficiency, spending patterns, investment habits, and retirement progress. Small, intentional adjustments like boosting contributions, harvesting losses, or timing income can compound into significant long-term growth. Treat your return as a strategic review, not just compliance, and you’ll turn tax season into an opportunity for lasting financial freedom.

This is where having an attorney and a tax advisor becomes really valuable; they can help you understand the numbers, identify legal and tax-efficient strategies, and align your tax picture with your broader estate and wealth planning goals.

FAQs: frequently Asked Questions

Ques 1. Can reviewing my tax return reduce my future tax burden?

Ans. Yes. Identifying opportunities like retirement contributions, tax-efficient investing, income timing, or loss harvesting can help lower taxes over time.

Ques 2. What deductions and credits can I claim on Form 1040?

Ans. Common deductions may include mortgage interest, charitable contributions, medical expenses, business expenses, and retirement contributions. Credits can include education loans and child tax credits. And the eligibility depends on your income level and financial situation, so reviewing this section carefully can help you avoid missing valuable tax benefits.

Ques 3. When should I really bring in a tax attorney or financial advisor instead of handling this myself?

Ans. If your situation includes business ownership, significant investment sales, multi-state income, high AGI, complex charitable or estate planning goals, or family wealth transfer questions, professional guidance can save far more than it costs and help avoid costly mistakes.